It’s mid January and 1098s and 1099s are starting to arrive. If you’re expecting a refund, you’ll want to get those taxes filed as soon as you’ve collected all of your tax related documents, but do you know where everything is?

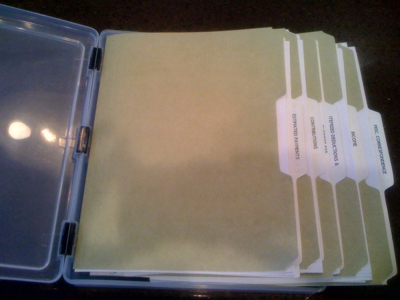

Filing your taxes can be a snap if you have all of the necessary paperwork organized, and believe it or not, keeping your tax files under control is easy with just a few tools: an Iris Clear Plastic Project Case and five to ten manila folders.

The first step in setting up this system is to title your manila folders: Income, Estimated Tax Payments, Itemized Deductions, Charitable Contributions, Medical Expenses, Un-reimbursed Business Expenses, Correspondence with IRS, Sales of Investments, are all possible choices, though you may have more. The categories you use are dependent upon your own personal tax situation, but will certainly include income and deductions.

The first step in setting up this system is to title your manila folders: Income, Estimated Tax Payments, Itemized Deductions, Charitable Contributions, Medical Expenses, Un-reimbursed Business Expenses, Correspondence with IRS, Sales of Investments, are all possible choices, though you may have more. The categories you use are dependent upon your own personal tax situation, but will certainly include income and deductions.

Next, place the folders into the Project Case and place it on a shelf or in a drawer near your desk or where you process your paperwork.

During the year whenever you complete a transaction that may have tax impact, such as making a charitable contribution, place the supporting documentation you receive in the appropriate folder in the box. As 1099s, 1098s and W-2s arrive in your mailbox, you’ll have a place to put them and when filing time rolls around everything you need is already gathered and sorted, which as we all know is half the battle.